Transparency and Engagement

Our mission is to promote a transparent engagement and to contribute to the creation of a sustainable society.

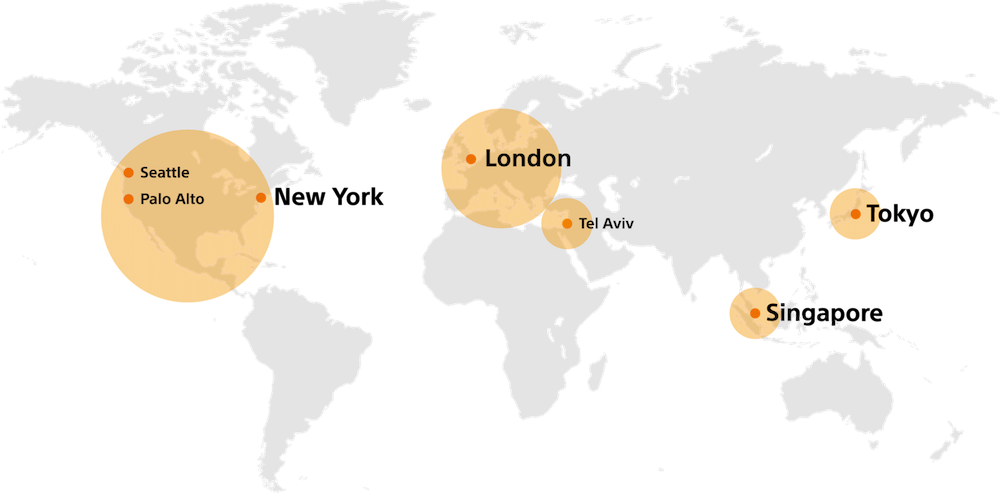

We have a local network of institutional investors in New York, London, and Singapore who are interested to invest in Japanese companies.

We provide up-to-date information and surveys to a wide range of listed companies in Japan.

The matching between listed companies and domestic and foreign investors have been successfully made based on our existing expertise.

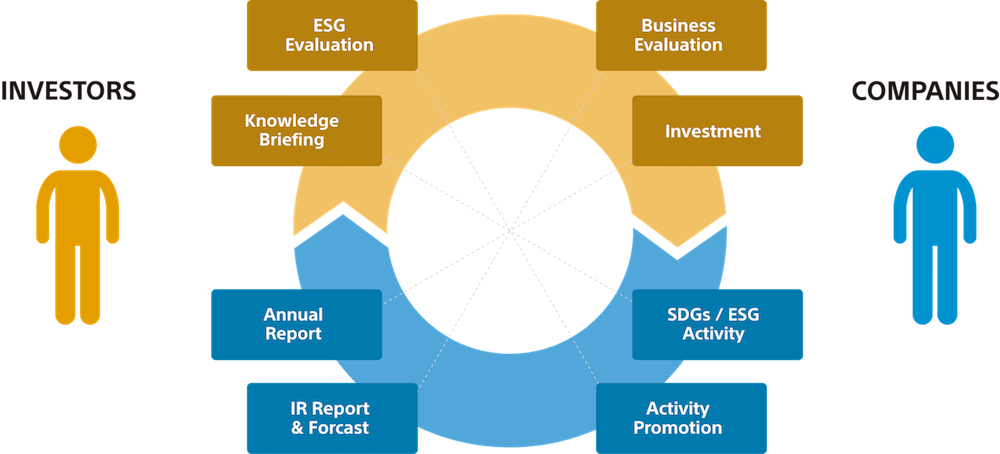

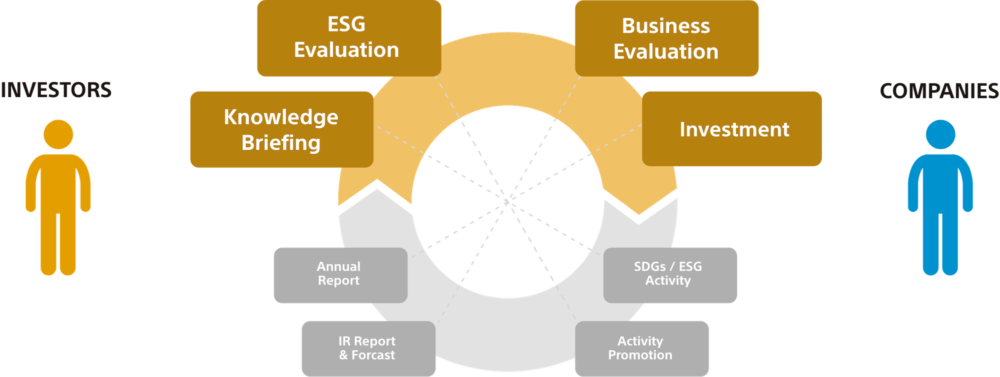

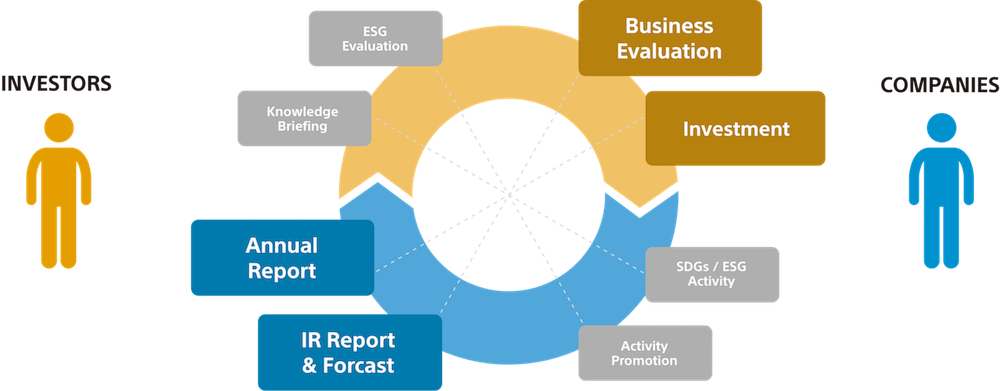

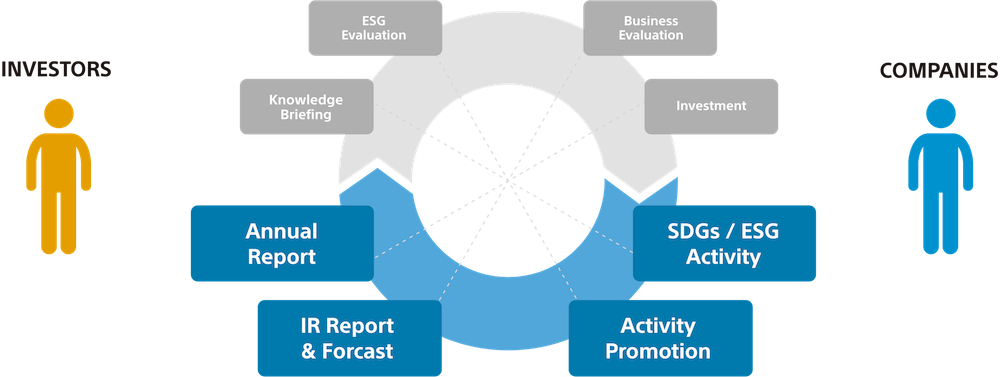

We put great emphasis on understanding the needs of global institutional investors. We aim to respond to a wide range of needs from investors, as well as supporting Japanese companies’ IR (investor relations) activities. Our goal is to raise the profile of Japanese companies within the investor community. We provide a platform to serve both institutional investors and companies that would help fill in the communication gap. We aim to provide optimal matching opportunities for both parties.

ESG Format

We compile the summary of ESG/SDGs activities of Japanese companies in our proprietary format.

We aim to make it useful for investors with comparison across sectors.

This support is jointly engineered with Minsetsu Inc.

Investors Voice

Provide up-to-date commentary by ESG experts in Europe and the United States.

It works as an indicator of the needs of investors, fund managers and ESG analysts who are in charge of engagement investments.

Matching Service

Provide matching services between institutional and ESG investors and companies.

We have exclusive access to domestic and foreign institutional and ESG investors in Europe and the US for conference calls, and overseas IR tours.

There are many things we should keep in mind if we want to make corporate activities meaningful. Activities to improve society, such as SDGs and CSR, are not merely a contribution to society. The activities themselves need to be carefully incorporated in the company's business model so that it ultimately leads to an increase in corporate value. With an investor's perspective, we help optimize the communication cycle for investors and companies.

Investors Voice

We deliver messages from ESG specialists in Europe and the US, which are specially designed for Japanese companies. To gain a deeper understanding of what investors expect for Japanese companies, we publish a commentary by fund managers and ESG experts. We hold regular discussions with investors from major investment institutions and deliver the message to the companies.

We have regular discussions with institutional investors including Fidelity, BlackRock, and others.

We try to provide investors’ perspectives on how they evaluate companies’ activities associated with ESG and SDGs. We suggest a simple solution: “Ask investors directly.” We have regular discussions with fund managers, ESG experts, and analysts and deliver the opinion in the form of commentary. Listening to investors' opinions should help Japanese companies to formulate relevant strategies.

Matching Service

We provide opportunities to meet the demand of both Japanese companies and institutional investors by tuning the demand of both parties. We believe this approach leads to satisfactory meetings, teleconferences, and overseas roadshows.

We have a local network of institutional investors in New York, London, and Singapore who are interested to invest in Japanese companies.

We provide up-to-date information and surveys to a wide range of listed companies in Japan.

The matching between listed companies and domestic and foreign investors have been successfully made based on our existing expertise.

We try to provide investors’ perspectives on how they evaluate companies’ activities associated with ESG and SDGs. We suggest a simple solution: “Ask investors directly.” We have regular discussions with fund managers, ESG experts and analysts and deliver the opinion in the form of commentary. Listening to investors' opinions should help Japanese companies to formulate relevant strategies.

ESG Format

We compile the results of corporate ESG/SDGs activities in its own format and provides them to investors as a basis for making investment decisions. This product is developed jointly with Minsetsu Inc.

For companies: As many of you are aware, a number of bottlenecks make it difficult to convey the companies ESG/SDGs activities to global investors. “Is the integration report really appreciated by investors? If not, why?” More effective ways of communication will be incorporated into the enterprise value. We aim to address this issue by using surveys as well as statistical data to ensure a better understanding for both companies and investors.

With our proprietary ESG format, we aim to provide a fresh perspective for investors by comparing the disclosed investor relations-related documents across sectors. By providing a global comparison of the listed companies, we would like to reconsider the measures to deepen the dialogue with global investors. We, at the same time, deliver ‘your voice’ to companies so that more transparent dialogues could be created.

We put great emphasis on understanding the needs of global institutional investors. We aim to respond to a wide range of needs from investors, as well as supporting Japanese companies’ IR (investor relations) activities. Our goal is to raise the profile of Japanese companies within the investor community. We provide a platform to serve both institutional investors and companies that would help fill in the communication gap. We aim to provide optimal matching opportunities for both parties.